Currently Empty: $0.00

Learn Trading by Observing Real Trading Decisions Live.

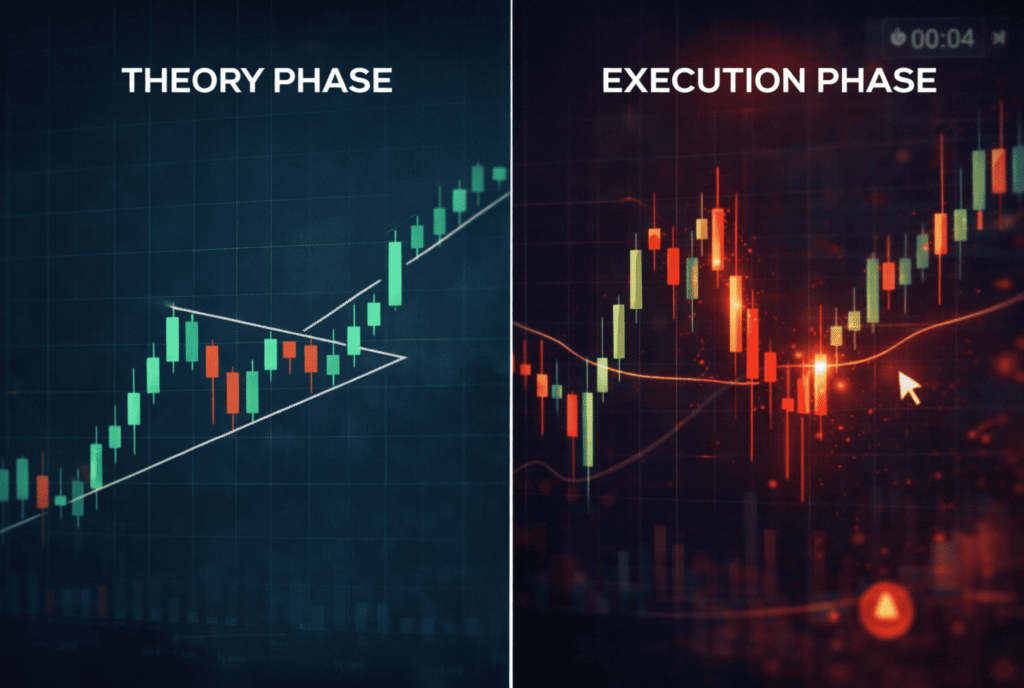

Because knowing the charts isn't the same as executing live in real markets.

Step into a live trading room where decisions happen in real time.

- Learn By observing Real-time trade entries

- Trade management

- Emotional control during live execution

- Learning by observing live decisions

Mistakes don't happen on charts. They happen under pressure.

WE FILL THE

BIG GAP

BETWEEN KNOWING

AND DOING

When emotions take over your knowledge

Most traders don't fail on charts.

They fail at the moment of decision.

Alpha Traders bridges this gap by letting you watch real decisions live — not by

explaining trades after they happen.

Why Alpha Trading Community Is Built for Real Learning

97% traders don't fail because of lack of knowledge. They fail when decisions must be made live.

What traders already have

Strategies

Indicators & patterns

Even their real edge

What actually happens in live markets

FOMO, Greed, Fear & Pressure take control

Real Money is at risk

Real Pressure build up

Alpha Traders is built around live market exposure.

This is not only the education. This is live exposure to real decision Making.

Observe complete trade cycles — from entry to exit

See trade management under real pressure

Learn when to stay in, when to exit, and when to do nothing during Live Trading Sessions

Understand trading psychology as it unfolds live

You’re not alone while the market is moving. You’re watching how decisions are actually made in my Live Trading Room.

Fear Replaces Logic When Markets Move Live

When price moves against a trader, hesitation begins and the mind starts questioning knowledge, shattering confidence.

Even stop-losses are your safety net — fear freezes your execution on A+ setups.

Strong setups are missed right in front of your eyes, and emotions make you take the wrong decisions.

In our live trading room, you observe every single trade — as it happens.

You see entries, exits, and hesitation in real time

You watch how decisions are made in real time

You learn from execution — not explanations

You will also spot mistakes and learn how to avoid them.

What You Actually Get Inside Alpha Traders

Learn from live trading setups

Observe complete trade cycles from entry to exit as they happen in real market conditions.

Overcome trading psychology

Learn when to trade and when not to by observing decision-making under real pressure.

Alpha-only educational videos

Access exclusive content designed to build understanding of market structure and execution.

Join the live trading room daily

Observe real decisions as they unfold, learning from live market exposure rather than replays.

You don’t leave with more information.

You leave knowing how to think when the market moves.

Choose Your Access

7 Days (Trial Version)

$9

Trial access to live trading room

Live trading room access

Observe real-time trade execution

See how entries, exits, and decisions happen live

30 Days

$25 / month

Full month of live market exposure

Live trading room access

Real-time decision observation

See how trades are managed step-by-step

Psychology under live market pressure

Loyalty Rewards & Perks

- Temporary access upgrades

- Member-only perks during active subscription

- Discounts on Alpha Traders products

Yearly Access

$199

Save $101 compared to monthly billing

Full year of live market immersion

Live trading room access

Priority member access

Full access to member-only videos

Long-term exposure to real market conditions

Member Privileges:

- Early access to new features & sessions

- Priority access to limited live formats

- Guided personalized review sessions (limited availability)

Frequently Asked Questions

What is Alpha Trading Community?

A live learning environment where traders observe real decisions being made in real market conditions.

Is Alpha Traders a signal group?

No. We do not provide buy/sell signals or financial advice.

What will I learn inside the live trading room?

You observe entries, exits, trade management, risk handling, and emotional control in real time.

Is this suitable for beginners?

Yes — if the goal is to learn decision-making, not shortcuts.

You don’t leave with more information.

You leave knowing how to think when the market moves.